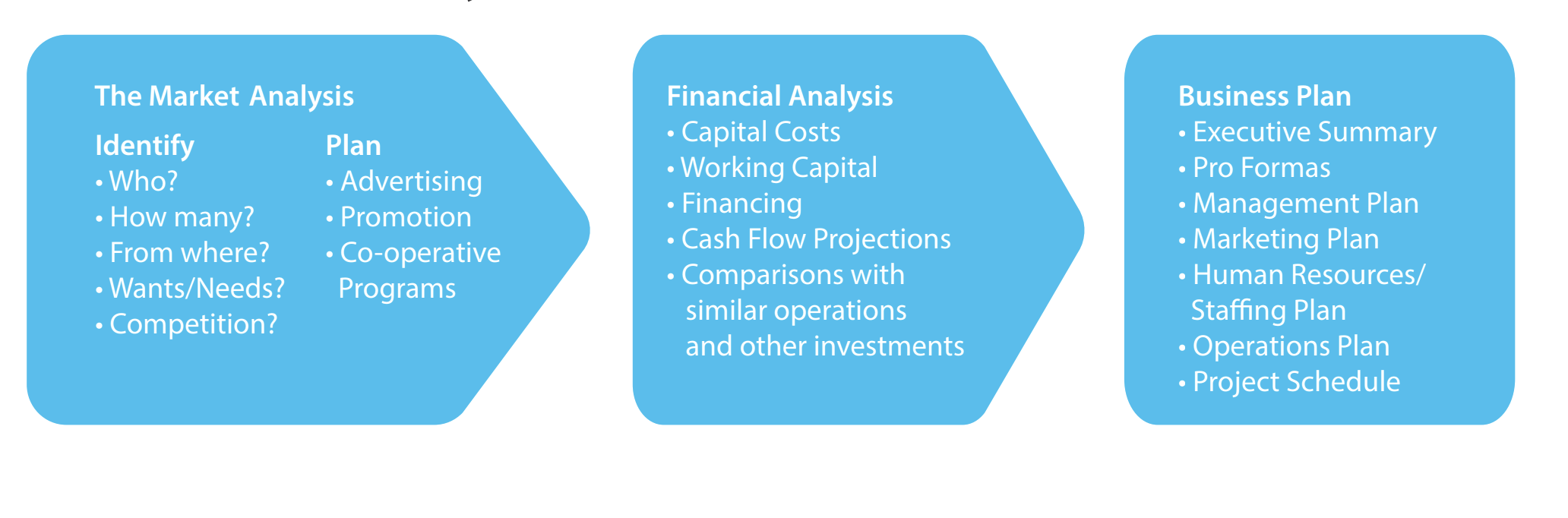

Generally, an economic feasibility study is carried out in three separate steps:

- market analysis

- financial analysis

- the business plan

If you are hoping to develop a major facility, now is usually the time to engage an outside consultant to study the economic feasibility of the proposed tourism development. The developer of a smaller project may not require such assistance but should still carry out an analysis using the three steps.

Tourism Saskatchewan's Product Development Department provides potential developers advice about:

- Drafting the terms of reference and other written terms and conditions governing a study

- Selecting a number of consultants to prepare formal written proposals

- Choosing a consultant

- Reviewing the consultant's work throughout the study process to ensure that the developer's objectives are being met

- Determining alternate sources of funding for the study

Step One: Market Analysis

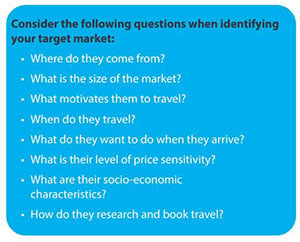

The market analysis looks in detail at the present and anticipated competition for the proposed development. It considers any complementary developments, such as new attractions and nearby recreational opportunities (e.g. golfing, snowmobiling, skiing, fishing). In rural Saskatchewan, consideration must be given to the impact of possible future conversion of surrounding landscapes due to forest harvesting, mineral developments or agricultural diversification. In urban locations, the potential impact of nearby commercial and industrial developments should be kept in mind. A market analysis will also help you to determine if the proposed scale of your project is appropriate, based on the market demand and consumer preferences uncovered in your research.

The following points should be stressed when the market analysis is carried out:

The following points should be stressed when the market analysis is carried out:

- Examine the segments of the market that have special potential because of your project's proposed location, facilities and activities. These segments will include independent travellers, motorcoach, seniors, corporate retreats, recreational vehicle travel, paleontological tours, etc.

- Identify opportunities to package your facilities and services with those of complementary businesses and attractions, such as golf courses, exhibitions and fairs, cultural events, museums, etc.

- Explore in-market partners who could help market and sell your product, such as tour operators, tour wholesalers, receptive tour operators, etc.

- Break down the market by geographic origin, type of facilities and activities sought, such as groups seeking ecological and cultural experiences, snowmobiling clubs, reunions, young families on vacation, etc.

- Investigate the performance of similar businesses in the area.

- Consider all types of revenues from all information sources available.

- Price your product competitively to attract business and generate sufficient income, while keeping in mind that you will need to build the cost of commission into your retail price if you plan to use tour operator services to sell your tourism product. Do not try to compete on the basis of price. In tourism, the cost of labour accounts for as much as 35-40 per cent of the cost of the product.

Given costs and availability of labour in Saskatchewan, you are unlikely to compete successfully with other lower-cost jurisdictions vying for the same market. - Prepare a marketing plan that includes a detailed strategy to optimize revenues on a sustainable basis, and co-operatively participate in the marketing and promotion plans developed and implemented by tourism sector associations and Tourism Saskatchewan.

Tourism Market Information:

- For more information about tourism industry activity in the province, visit Tourism Saskatchewan’s consumer website. Tourism Saskatchewan’s travel literature series can be downloaded or ordered online, free of charge.

- Marketing research and information is available in the Research and Statistics section.

- Destination Canada (DC) provides market information and resources for Canada’s tourism industry.

- Statistics Canada surveys and interprets data on domestic and international travellers, and on Canada’s tourism sector. Findings are presented in the Travel Survey of Residents of Canada (TSRC), the International Travel Survey (ITS) and the National Tourism Indicators (NTI) quarterly publication.

- You may register for a free membership to the Canadian Tourism Research Institute (CTRI) to access information, including the bi-monthly Travel Exclusive newsletter. Research documents are accessible for a fee.

Step Two: Financial Analysis

The financial analysis will generally proceed as follows:

Capital Costs

Based on the information obtained about your market and from your earlier work in defining the project's physical characteristics, estimate the total capital costs of the development. This can include land acquisition, site preparation, servicing, landscaping, construction, furnishings, fixtures and equipment, possible interpretive displays and programming, leasehold improvements, vehicles, related engineering, architectural and community planning costs and other services. This information should, wherever possible, be supported by written quotations. It is advisable to add at least 10 per cent to guard against cost overruns.

Soft Costs

Based on your operations plan, estimate your soft costs:

- Hiring and training staff

- Legal and professional services required for start-up (other than those previously attributed to capital)

- Working capital* required, marketing and start-up costs

- Operational support to sustain operations until break even is achieved

More tourism start-ups fail because of underestimating soft costs than for any other reason.

It is much easier to use excess capital if you reach break even early in the process than it is to finance an operation that is not yet making money. (Remember to include the Provincial Sales and the Goods & Services taxes in your estimates.)

*Working capital refers to the liquid assets available to a company – current assets minus current liabilities.

Financing

Determine how the venture will be financed. This will include your cash equity, cash investments from other shareholders or partners, loans from banks, credit unions and other conventional lenders, and assistance that is sometimes available through economic development organizations. Financing must cover all of the identified capital and soft costs.

Cash Flow

Schedule the flow of cash required to bring the project into commercial operation. This is vital because your own cash investment will probably be spent first, followed by disbursement of borrowed funds. As accurately as possible, estimate the monthly expenses that will be incurred over the first 12 months of operation. This will enable you to determine the working capital required to sustain the business during the critical first year of operation. If your operation is seasonal and dependent on favourable weather conditions, your initial working capital requirements could amount to more than six months of operating expenses, including funds for debt servicing and cash needs in the off-season.

Project Financial Statements

Prepare projected financial statements. These will include balance sheets, income statements and cash flow statements.

- Balance sheets will reflect the capital structure of your business – its assets, liabilities and owner's equity. They will show the projected liquidity of the venture, which is the current assets that can quickly be converted to cash in order to pay current liabilities, including loan payments. They also show the extent of debt being carried in relation to the equity that the owners have contributed or accumulated.

- Income statements – projections of revenues and expenses – should be prepared on a monthly basis for the first three to five years of operation. Income estimates will be determined based on reasonable expectations considering the information that you have obtained about your market. The revenue and expense projections will allow you to ascertain whether the business operation will generate sufficient revenues to cover expenses. If break even is not evident, some adjustments to the project may have to be made, which will result in increased revenues and/or decreased expenses to make a profit. Remember to take interest charges and a range of income scenarios into account when preparing your income statements.

- A projected cash flow statement (Statement of Changes in Financial Position) reveals cash inflow and outflow, and clearly identifies debt-servicing requirements. Remember, you do not spend profits that can be tied up in inventories and accounts receivable or noncash contributions of goods and services, and which may come from shareholders, sponsors and volunteers.

Competitive Analysis

Compare the projected and/or actual financial performance of your venture with actual results of similar operations and the industry in general. This information is sometimes available from provincial and/or national industry associations, and will help you to determine whether your projections are realistic or not. You should go back and review your assumptions and rework the projections accordingly.

Similar to the private sector, non-profit and community organizations need to source funding to support the development of tourism projects.

It is important to be aware that funding for non- profits is most often in the form of capital grants, with very few operational grants available. Non-profits must be able to show how they will operate self-sufficiently and how they will generate revenues from fundraising and other means.

In all cases, avoid the mistake of retroactively adjusting revenues to justify costs. This path leads to hardship and regret. If your projections do not indicate a feasible investment, go back to the start and re-examine all of your assumptions.

Step Three: Business Plan

A business plan is a “road map” to guide you through the actual commercial operation of your venture. Business plans include several components:

Executive Summary

An executive summary encapsulates the highlights of your business plan. Strive for clarity and precision in your summary to engage your targeted readers.

Financial Information

Projected financial statements (pro forma) and a financing plan should be included to estimate how much profit your business will earn over a given period of time. Pro forma financial statements forecast future levels of balance sheet accounts, in addition to your projected profits and your anticipated borrowing.

Management Plan

A management plan shows the organizational/corporate structure of your business, including background information about you and your partners, your abilities, business goals, vision and the inspiration for your new business venture. Identify any shortfalls and explain how you will address these.

Marketing Plan

Develop a detailed marketing plan and budget. Consider the following points:

- Solid marketing plans are based on the goals identified in your business plan and the results of your previous market research, and should include budget estimates for each marketing tactic you are planning.

- Marketing plans should be developed for multiple years and clearly state the timeline and roll-out of advertising and promotional plans. Identify how you envision your presence growing in the marketplace over time.

- Marketing is far more than placing ads here and there. You need to build a consistent plan that takes several marketing channels into consideration, including public relations, advertising, print materials, promotions, online presence and social media.

- Public relations are an important and cost-effective way to communicate information about your business to media. Develop contacts with media in your local area and target markets, and consistently communicate new developments and business activities, as well as special events. Third-party articles will lend credibility to your venture, and local press will build community awareness. Well-written and strategically-timed press releases, along with professional looking media kits are essential. Consult Tourism Saskatchewan’s Travel Media Department for more information on getting your story out to travel writers and participating in media familiarization (FAM) tours.

- Advertising is an expensive but effective means of marketing if ads are appropriately placed in your target markets and have frequent exposure. You should strive toward ads that feature compelling visuals. Establish goals or benchmarks to measure the effectiveness of your advertising. Include the development of a high-quality logo, professional photography and graphic design services into your plan.

- Develop an online presence for your business, including a website and social media components. Print advertising, radio, television, billboards and direct-mail pieces will drive visitors to your website. Make sure it is functional and up-to-date. Social media applications, such as Facebook, Twitter, Instagram, YouTube, Tumblr and Flickr have become important marketing tools. They are relatively inexpensive, allow you to tap into new markets and encourage interaction between your business and potential customers.

- Investigate the possibility of joining your local tourism organization, Destination Area or Destination Marketing Organization for membership benefits, which may include listings on websites and in literature, discounted workshop fees and eligibility to participate in wider-reaching cooperative advertising campaigns. Additionally, partnership opportunities may be available to attend consumer and trade marketplaces.

- Include an estimate of the cost of developing and maintaining your marketing materials and participating in marketing activities on top of the costs of buying media. Logo development, photography, website design, brochure costs, promotional collateral, tradeshow exhibit design and construction, tradeshow registration, membership fees, travel and staffing costs will all need to be considered and included in your operational costs.

Human Resources / Staffing Plan

There are several aspects to consider when developing a human resources plan:

- Develop a comprehensive staff training plan for management, non-management, partners, shareholders and anyone else who will be involved in the venture. Tourism Saskatchewan's education department, Workforce Development, is nationally and internationally recognized for its delivery of programs in support of human resource development in the tourism sector. This training includes National Occupational Standards in 31tourism occupations and 26 certification options in both professional and specialist categories.

- Build a plan to recruit and retain staff. Tourism ventures are often seasonal and, as a result, experience high staff turnover. You will need to take this into account and build a plan to meet these challenges.

- Account for the costs of compensation, salaries, insurance and benefits in your staffing plan. Recruitment and retention costs can be extensive and, therefore, should be calculated here.

- Research labour and employment standards and costs. The Labour Standards Branch of the Ministry of Labour Relations and Workplace Safety is responsible for enforcing the standards under The Labour Standards Act.

- Develop a succession plan to protect your business and ensure its continuity in the event that you sell, retire or leave due to unforeseen circumstances.

Operations Plan

Prepare an operations plan detailing the physical requirements and the identified considerations, priorities and strategies for managing a successful business.

Project Schedule

Include a schedule that will help you proceed in an organized manner. Show the gradual advancement of the project through regulatory agencies, financial institutions, suppliers and contractors. Identify pre-opening training and marketing activities.

A Business Plan can be an effective tool only if it is based on cautious economic analysis and realistic use of information, and if it is followed and updated regularly. For example, the business plan should allow for higher than prevailing interest rates, so that the impact of changes in the cost of debt servicing will have been anticipated in advance.Including assumptions in terms of costs and revenues allows lenders and funding agencies to see that you have put thoughtful consideration into the numbers that you are presenting.

The importance of analyzing the financial feasibility of a tourism development is as relevant to smaller projects, such as seasonal attractions and retail businesses, as it is for large-scale projects such as four-season resorts and major interpretive centres.

Business Planning Information:

- The Canada Business Network with the Government of Canada provides valuable resources for entrepreneurs, including information on marketing, business and marketing plan templates and funding sources.

- Industry Canada offers an online Small and Medium-sized Enterprises (SME) Benchmarking Tool that affords access to income statements and balance sheet data for small- and medium-sized enterprises specific to your industry.

- The Ministry of Labour Relations and Workplace Safety's Labour Standards Branch can provide information on labour and employment standards.

Economic Feasibility